IRA Rollover and DAFs

Make St. Louis Center the recipient of your IRA RMD Rollover or consider supporting the Center through your DAF.

Become a Monthly Sustainer

Give the ongoing gift of a secure home, quality care, and fun activities. Set up your recurring donation schedule.

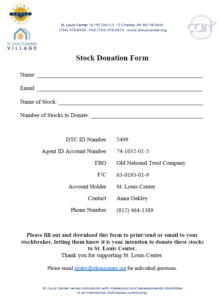

Make a Donation of Stock

Learn more, then either print/send the pdf Stock Donation Form or fill out the online Stock Donation Form

Set Up a Planned Gift

What will your legacy be? Learn about the ways to make a planned gift through bequests, endowment, charitable trusts, and more.

There are many avenues to support our residents.

Our work is magnificent, but our needs are great.

Your generosity is more important now than ever in helping to ensure the continuing care of our residents. Every donation helps, from one-time gifts to matching funds or gifts of stock, property, or bequests.

If you are touched by the stories of our residents or the importance of our mission, please consider contributing in whatever way is right for you. And remember, one of the most fulfilling ways is to attend our many community volunteer activities.

St. Louis Center is a 501(c)(3) nonprofit organization.

Federal Tax ID: 38-6038121

Donate Now!

Have your support felt immediately.

- Click here to make a one-time donation by credit or debit card, or

- Download and print this form to mail a check to

St. Louis Center

16195 Old U.S. 12

Chelsea, MI 48118

Monthly Sustainers

Make your gift last when you become a sustainer.

You can spread out your gift over time by making a recurring donation. It’s convenient and may allow you to make a larger gift by spreading out your payments over time. Just visit our online donation form here or call 734-475-8430 to set up a recurring donation that will automatically be charged to your credit card. You decide how much you want to give, the payment schedule (monthly, quarterly or annually) and the timeframe for your gift.

Remember a Loved One, Honor a Special Person, or Commemorate a Significant Occasion

Making a gift in memory of a loved one, to honor a special person, or in commemoration of an important event is a great way to make a personal and lasting tribute. Just note on your check or the online form that your gift is in memory or in honor of someone you care about.

Making a gift in memory of a loved one, to honor a special person, or in commemoration of an important event is a great way to make a personal and lasting tribute. Just note on your check or the online form that your gift is in memory or in honor of someone you care about.

If you provide the name and contact information of the family member of the memorialized person or the person to whom you are paying tribute, St. Louis Center will send a letter to the honoree or family of the deceased to notify them of your gift, without revealing the contribution amount.

If you would like this notification to be sent, please provide the notificant’s name and address when you make your gift online or providing the information when you send a check to St. Louis Center, 16195 Old US 12, Chelsea, MI 48118.

In-Kind Donations and Needs Lists

In-Kind Gifts

We welcome your help in keeping the 64 residents at the Center clothed, fed, and engaged each day, and to provide a safe, clean and cheerful environment. We rely on a wide variety of in-kind donations, including:

Food

Food

In-kind food donations help offset 25% of our food expenses each year and are most welcomed by the Center.- Personal Items and Clothing for Residents

New or gently worn clothing, coats, hats, gloves, scarves, and particularly toiletries and personal care items like shavers are always welcome. - Craft Kits, Books, and Supplies

Keeping residents occupied and engaged is important at St. Louis Center. We always need craft kits, books, and supplies like crayons, markers, and coloring books. - Tools and Lawn Equipment

Our maintenance department also welcomes a variety of tools and heavy-duty lawn maintenance equipment. - Vehicles

If you have a vehicle, particularly a van, a gator that can be used to remove snow, or golf cart that you no longer need and that is in good working condition, please consider St. Louis Center. - Furniture

Because of the special needs of our residents, we are limited as to the types of furniture that we can accept.

In-kind donations are tax-deductible as allowed by law.

If you have furniture or a larger item you wish to donate, or questions about any type of in-kind donation, please contact Development Director Wendy Zielen via email or at 734-475-8430.

Wish Lists Covering Specific Needs

St. Louis Center also maintains Amazon Smile Charity Lists to share specific needs for our residents, social work department, direct care staff, and maintenance workers. You can access these lists here. Anything you purchase will be shipped directly to the center!

St. Louis Center also maintains Amazon Smile Charity Lists to share specific needs for our residents, social work department, direct care staff, and maintenance workers. You can access these lists here. Anything you purchase will be shipped directly to the center!

Please note that these gifts are also tax-deductible as allowed by law, but for us to know and acknowledge that you are the originator of an Amazon Charity List gift with a tax receipt, you must specifically note your name and address upon shipping the gift.

Please note that these gifts are also tax-deductible as allowed by law, but for us to know and acknowledge that you are the originator of an Amazon Charity List gift with a tax receipt, you must specifically note your name and address upon shipping the gift.

Reminder for online shoppers: You help support SLC with every Amazon purchase by shopping at smile.amazon.com and making St. Louis Center your designated charity!

IRA Rollover

A tax-saving way to help St. Louis Center.

Making a direct transfer of funds from your Individual Retirement Account (IRA) can count toward satisfying your Required Minimum Distributions (RMD) for the year.

Why Consider This Gift?

- Your gift will be put to use today, allowing you to see the difference your donation is making.

- You pay no income taxes on the gift. The transfer generates neither taxable income nor a tax deduction, so you benefit even if you do not itemize your deductions.

- Beginning in the year you turn 73, you can use your gift to satisfy all or part of your required minimum distribution.

- Since the gift doesn’t count as income, it can reduce annual income level. This may help lower your Medicare premiums and decrease the amount of Social Security that is subject to tax.

- You may donate up to $100,000 total to one or more charities from a taxable IRA.

You may have a new ‘best friend’ after seeing the tax benefits of rolling your IRA over to St. Louis Center.

Contact your IRA administrator or financial advisor to send your gift directly to St. Louis Center, Tax ID# 38-6038121. For additional information please contact SLC Development Department at 734-475-8430 or slcdev@stlouiscenter.org.

Donor Advised Funds (DAFs)

Donor Advised Funds (DAFs) provide people with a way to make donations to charities they care about while continuing to allow assets to grow over time and potentially maximize tax benefits. One of the fastest-growing ways to support charitable organizations of choice, DAFs give the donor the ability to donate a wide range of generally accepted assets with the charity receiving the benefit in a format that is easy to accept. There is a wide variety of DAFs available for donors to choose from; please check with your financial advisor to select one that is right for you.

Of the many DAF providers to choose from, St. Louis Center accepts charitable giving from nearly all. If you already have a DAF set up with Fidelity Charitable, Schwab Charitable, or BNY Mellon, you can use the handy form to the right to designate a gift to St. Louis Center. Please contact your DAF provider directly to designate DAF gifts from other sources to St. Louis Center.

Gifts of Stock

When you donate stock to charity, you can generally take a tax deduction for the full fair market value of the stock on the date of the gift. For example, you purchased 50 shares of stock for $750 (or $15 each) and you donate those shares to your church on a date when the stock is worth $100 per share, you have given a gift of $5,000 to the church and the donation only cost you $750. In addition to getting the full fair market value for the gift of stock, you have also saved the capital gains tax that would otherwise be paid if you had sold the stock.

If you wish to donate shares of stock to St. Louis Center, either print/send the pdf Stock Donation Form below or fill out the online Stock Donation Form to the right and then forward the pdf you receive in your email to your stockbroker. This contains all the information your stockbroker will need to put the transfer in motion.

Planned Giving – What will your legacy be?

A planned gift will continue to proclaim the great dignity of any human person and follows several guiding principles of founder, St. Louis Guanella.

- Each human person has innate value

- Each person is considered worthy of respect, esteem, and love

- Creating family spirit is the central element of work with people with I/DD

By including St. Louis Center in your will or estate plans, you believe in making sure that people with I/DD have a place like the Center for love and support. We know that you would like our work to continue well into the future. Please consider making a future gift as part of your legacy

Ways to Make a Planned Gift

There are many different types of planned gifts, and each offers unique advantages. Some planned gifts are revocable – a gift in your will or living trust, for example – so you can change your mind at any time. Or, they can be irrevocable – just as outright gifts are – so that you benefit from an income tax deduction if you itemize.

Other Ways to Give

A way to make your donation go farther…

Does your company have a matching funds program?

Many companies and foundations provide a matching gift program that will match your charitable donations or volunteer hours. You can maximize your gift to St. Louis Center by contacting your organization’s HR department to find out if you have such a program. Follow the instructions provided by your employer’s Matching Gift Program.

Many companies and foundations provide a matching gift program that will match your charitable donations or volunteer hours. You can maximize your gift to St. Louis Center by contacting your organization’s HR department to find out if you have such a program. Follow the instructions provided by your employer’s Matching Gift Program.

Please direct Matching Gift inquiries or information to:

Development Department

16195 W Old US Hwy 12

Chelsea, MI 48118

slcdev@stlouiscenter.org

734-475-8430

Gifts of Property

Deeds or Titles to real estate may be donated to St. Louis Center.

A direct gift is the simplest method of donating real estate through a transfer of the property deed or title. As the donor, you generally receive a tax deduction equal to the fair market value of the property and that deduction may be carried forward for five years.

Contact the Development Department at 734-475-8430 or slcdev@stlouiscenter.org to discuss your proposed gift of real estate.

Are you missing notifications from St. Louis Center?

Are you missing notifications from St. Louis Center?

If your contact information has changed, or you would like to be on our list for the first time, it takes just a minute to update your record – Fast, Easy and Secure!

St. Louis Center keeps track of those who have donated to support its mission. It is important to us to keep our supporters informed, especially of upcoming events and Legacy Project progress. If you have donated to St. Louis Center and want to make sure that we have the most accurate, up-to-date information on file for you, please complete this form.

Know that St. Louis Center does not release donor records unless mandated by law.

If you are interested in becoming a donor or for answers to any questions you may have, contact Wendy Zielen, Development Director.